Month: February 2025

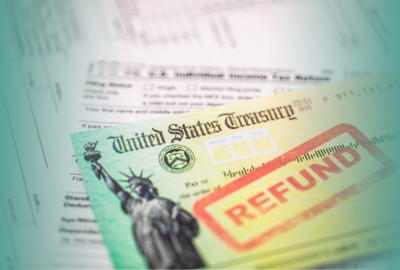

The Employee Retention Tax Credit (ERTC), a COVID-19 relief measure, offers a refundable tax credit to businesses maintaining staff. With an April 15, 2025 filing deadline for 2021 claims, prompt action is vital. Documentation and professional guidance can maximize benefits…

Read More

Navigating the Employee Retention Tax Credit (ERTC) can be complex, yet it’s invaluable for businesses aiming to maximize savings. With ERTC Express, companies can uncover hidden benefits, transforming confusion into clarity and financial gains, as they expertly guide you through the application process…

Read More

Starting and growing a small business is daunting, but with the right support, it becomes easier. Non-profits offer grants, low-interest loans, and mentorship programs that can significantly impact success. Engaging with these resources can foster growth and provide much-needed guidance and capital for small businesses…

Read More

Setting up payroll for your LLC is crucial. From obtaining an Employer Identification Number to accurately classifying workers and understanding payroll tax obligations, each step ensures compliance and efficiency. Simplify the process with our step-by-step guide to building a smooth payroll system for your business…

Read More

For small business owners, embracing a growth mindset is key to unlocking potential. By welcoming challenges, learning from setbacks, and fostering creativity, entrepreneurs can boost performance and innovation. Understand the principles of a growth mindset to propel success and foster adaptability in your business…

Read More

In today’s fast-paced business landscape, small businesses must embrace agile strategies to adapt swiftly to changes. By leveraging data analytics and fostering a culture of flexibility, they can identify market shifts early and enhance decision-making, ensuring longevity and success in a competitive environment…

Read More

How Much Does A Business Coach Cost: Pricing & Guide

- Feb 19, 2025

Business coaching costs range from $500 to $5,000 monthly, influenced by factors like coach experience, session pricing, and specialized knowledge. Understanding these elements helps make informed decisions. Analyzing cost components and setting clear goals ensure higher ROI from investing in business coaching…

Read More

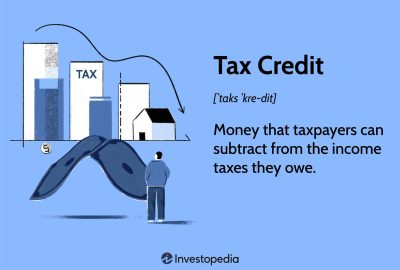

Discover how tax relief programs can help reduce your tax burden and streamline your finances. Learn about qualifying criteria and the various options available. Work with a CPA to maximize opportunities and ensure compliance with tax laws. Stay informed about changes to make sound financial decisions…

Read More

The Employee Retention Credit (ERC) is a vital tax credit introduced to aid businesses during COVID-19. Understanding eligibility, maintaining precise records, and meeting deadlines are crucial for compliance. Partnering with a tax professional can simplify complex processes and maximize refunds for businesses…

Read More

How To Get A Government Grant To Start A Business

- Feb 16, 2025

Government grants are a valuable resource for entrepreneurs seeking financial aid to start a business. These grants don’t require repayment. Understanding how to locate and apply, from federal to local levels, can significantly boost the chances of securing funding to launch your innovative venture…

Read More